As you navigate the winding roads of budgeting, investing, and saving, you'll encounter challenges and triumphs that shape your path forward.

From conquering debt to unlocking the secrets of smart investing, each milestone brings you closer to your ultimate destination: a future where financial worries are a thing of the past.

Time is the ultimate compounding machine and if you follow these 11 Financial Tips, your financial future will be brighter than ever.

- Optimize Your Insurance Coverage

- Master Credit Utilization

- Stay Tax Savvy

- Stay Informed on Interest Rates

- Strategize Your Home Purchase

- Harness Budgeting Tools

- Adopt the 50-30-20 Budget Rule

- Invest Wisely for the Future

- Build An Emergency Fund

- Choosing a Financial Advisor

Optimize Your Insurance Coverage

Shield yourself from financial risks by ensuring you have adequate insurance coverage. Protect your home, vehicle, and loved ones with the right policies that match your needs and budget.

Master Credit Utilization

Maintain a credit utilization ratio below 30% to bolster your credit health. This factor significantly impacts your credit scores, crucial for securing favorable terms on loans and mortgages.

Stay Tax Savvy

Avoid financial pitfalls by staying on top of your taxes. Leverage tax-deferred retirement accounts and consider user-friendly tax software to manage your tax obligations efficiently.

Pro Tip: Get ahead of the tax game with our tax strategy guide.

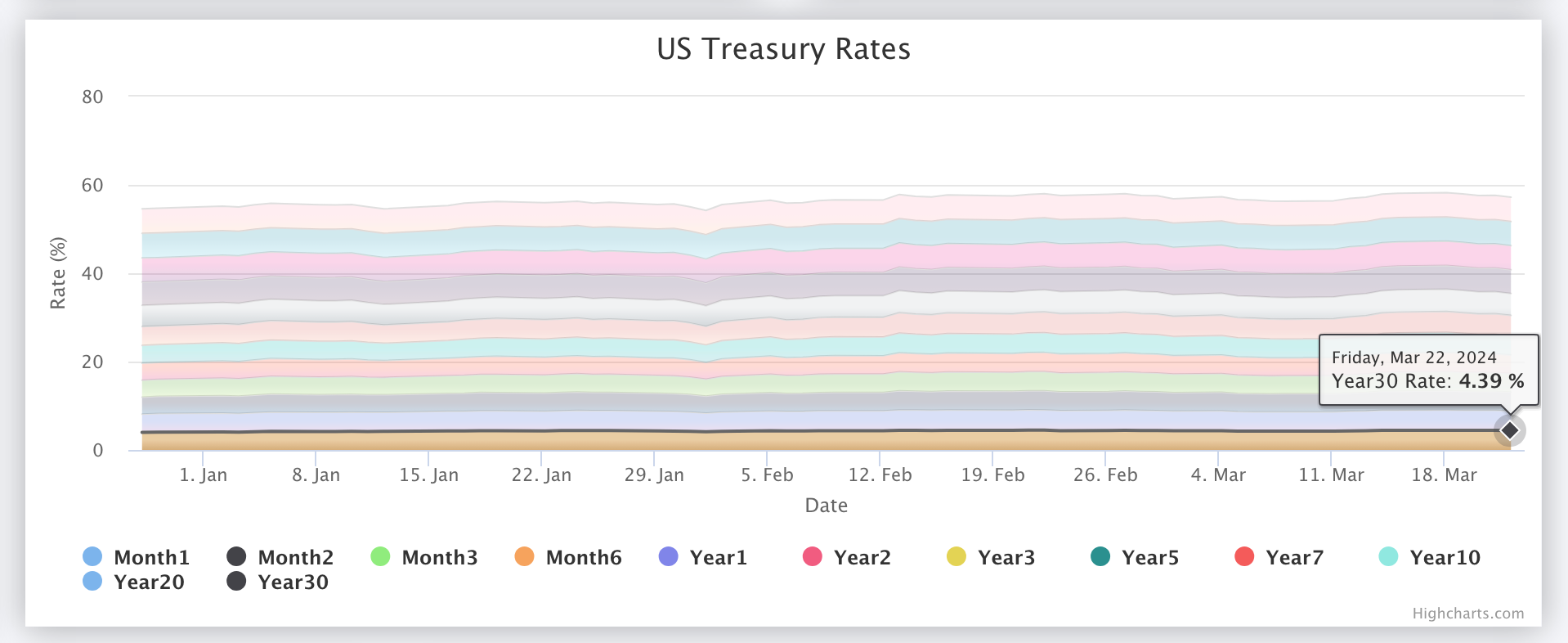

Stay Informed on Interest Rates

Stay vigilant about interest rates, which play a pivotal role in your financial decisions. Be aware of the rates affecting your various financial commitments and consider refinancing options if rates are favorable.

Pro Tip: You can use the Economic Indicators on Synvestable's Market View to see interest rates across the term spectrum.

Plan Ahead for College Expenses

Ease the burden of student loans by budgeting and saving for college early. Explore options like 529 college savings plans and consider in-state colleges for more affordable tuition fees.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

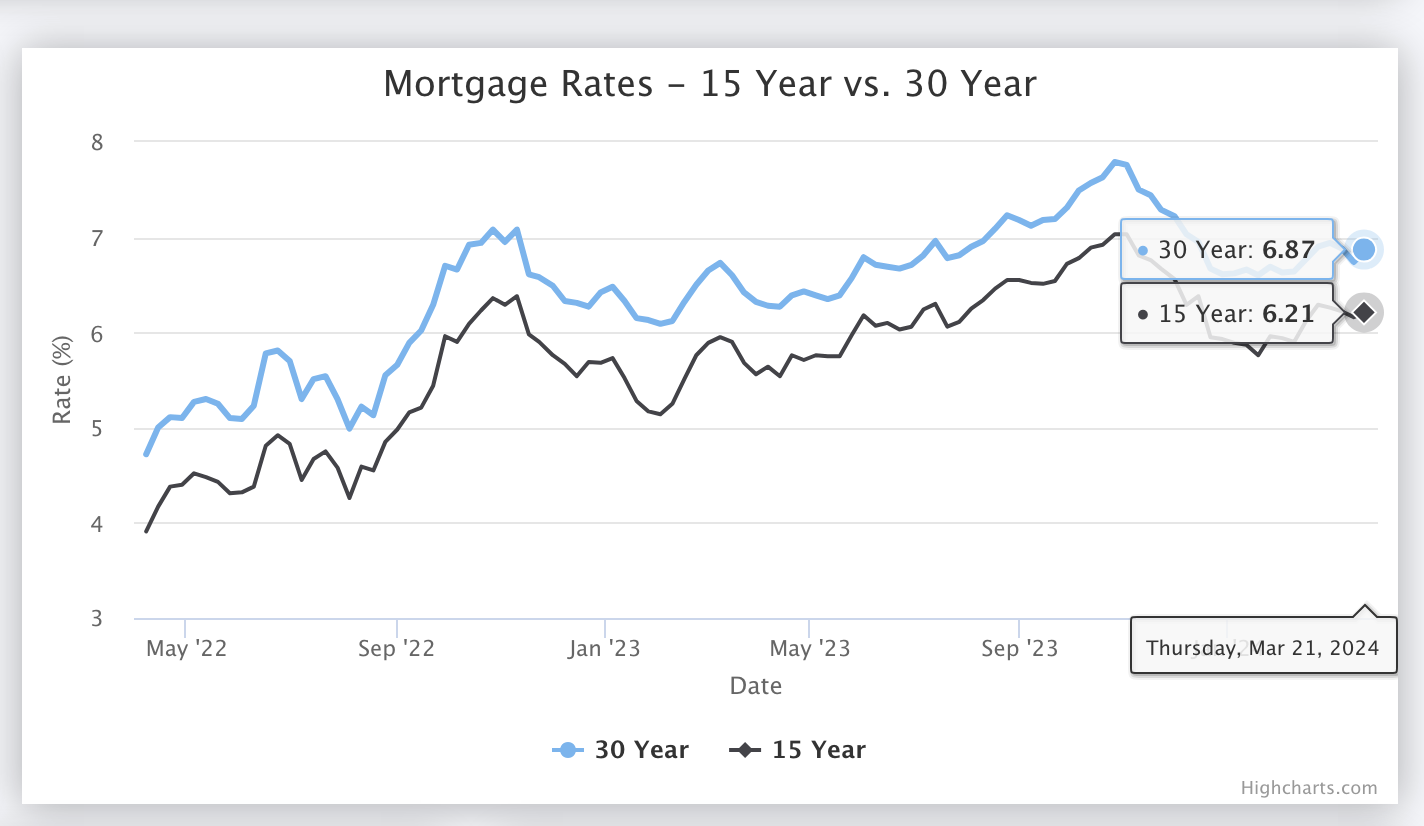

Strategize Your Home Purchase

Make informed decisions when buying a home by carefully planning your mortgage. Aim for a substantial down payment to secure better loan terms, leading to lower payments and reduced interest costs.

Pro Tip: You can use the Mortgage Rate tool on Synvestable's Market View to better plan your home buying horizon.

Harness Budgeting Tools

Simplify financial tracking with budgeting resources. Explore tools like Credit Karma’s budget calculator to manage expenses and make informed financial choices.

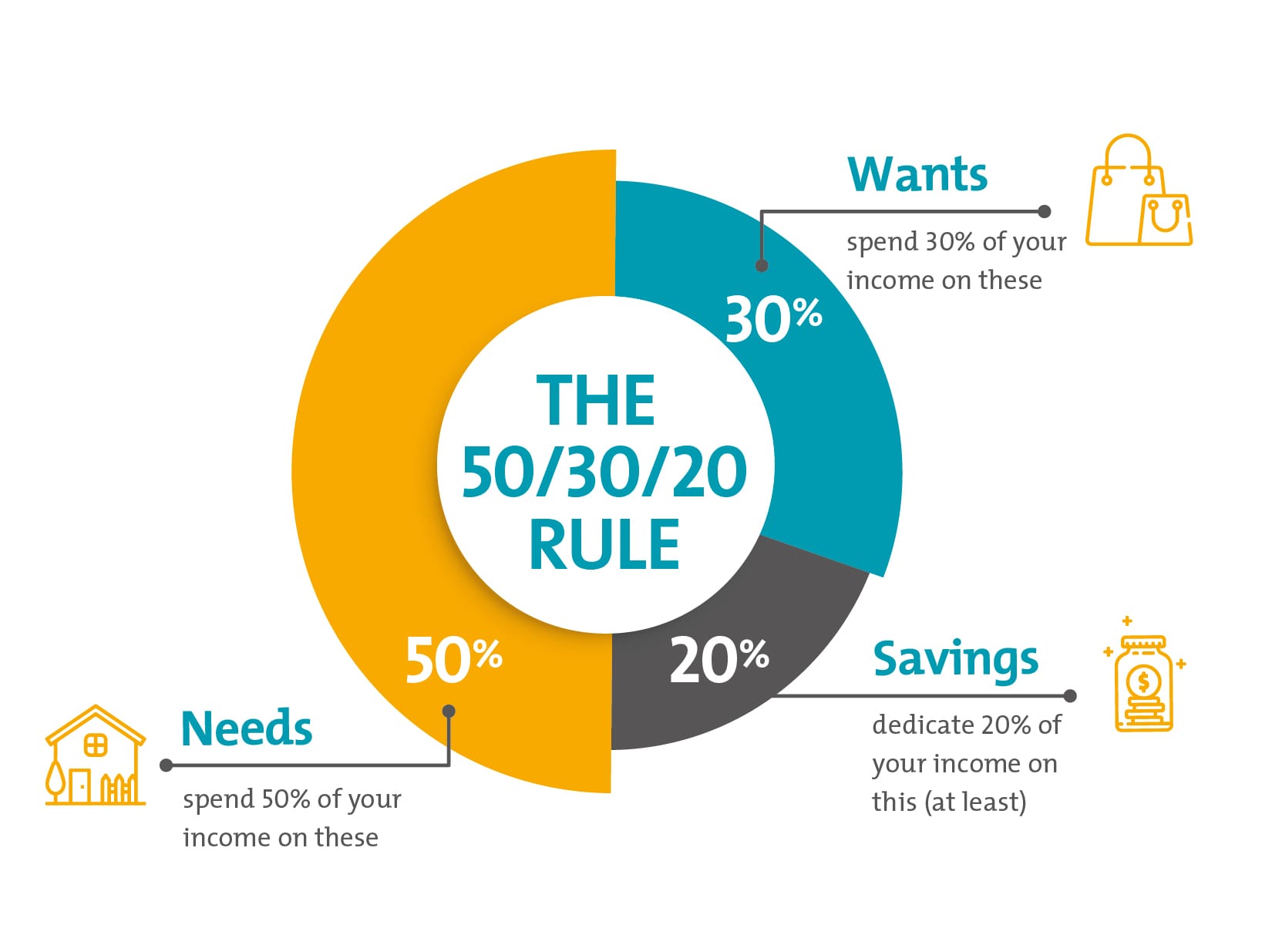

Adopt the 50-30-20 Budget Rule

Follow a balanced budgeting approach like the 50/30/20 rule to allocate your income effectively. Prioritize essentials, allocate a portion for discretionary spending, and save or repay debts with the remainder.

Invest Wisely for the Future

Grow your savings through smart investments in low-risk options like index funds. Maximize tax-advantaged accounts such as 401(k)s or IRAs before considering taxable investments.

Pro Tip: You can use Synvestable's Synsense Advisor to create thematic portfolios of ETF's and Index funds.

Build an Emergency Fund

Prepare for unexpected expenses by building an emergency fund. Aim to save three to nine months’ worth of expenses in a dedicated savings account to weather any financial storms.

Take charge of your financial future by incorporating these savvy tips into your financial planning strategy. With prudent financial management, you can achieve your goals and secure a stable financial foundation for the future.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Choosing a Financial Advisor

When it comes to choosing the right advisor, you want to look for a blend of experience, communication, investment approach, and a verifiable track record.

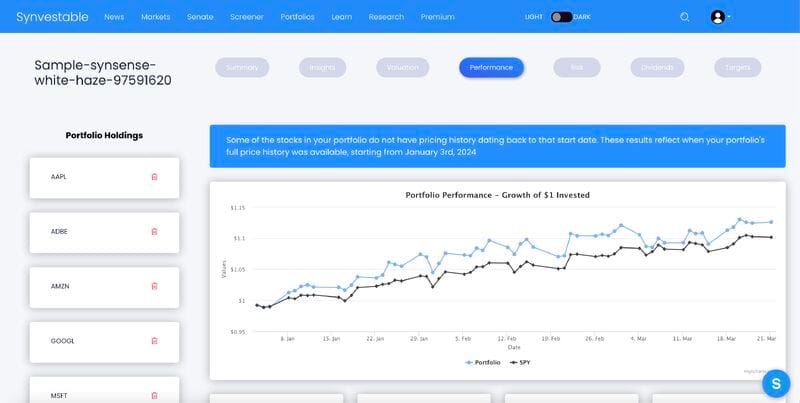

Luckily, Synsense Advisor matches all that criteria. This is our AI financial advisor that you can talk to 24 hours a day, who can build thematic model portfolios custom-tailored to your unique financial situation. And as far as track record, over half of the portfolios created with Synsense Advisor have beaten the market to date.

Check out our full demo of Synsense Advisor here.

And while you're there, you can...

Register For Free in Seconds!

The absolute best app in finance. Register in 3 seconds using your Google Account!